What are “opportunity zones”?

As explained by California’s Opportunity Zone Portal, opportunity zones “provide tax incentives for investment in designated census tracts”. The objective is to help inject capital into under-invested areas. It was established as part of the Tax Cuts and Jobs Act of 2017.

Opportunity zones and data centers

Data center developers have begun to take advantage of Opportunity Zones.

Orion Investment Real Estate notes that, “Fewer than one in 10 data centers built in the past 10 years was in an area now designated as an opportunity zone, according to CoStar data. Today, however, about 25 percent of the square footage proposed or under construction is scheduled for zones designated for special tax breaks under the program, according to CoStar.”

That’s a notable increase in the proportion of data center real estate developments that are leveraging the new Opportunity Zone tax advantages.

Here’s how it works at a high level.

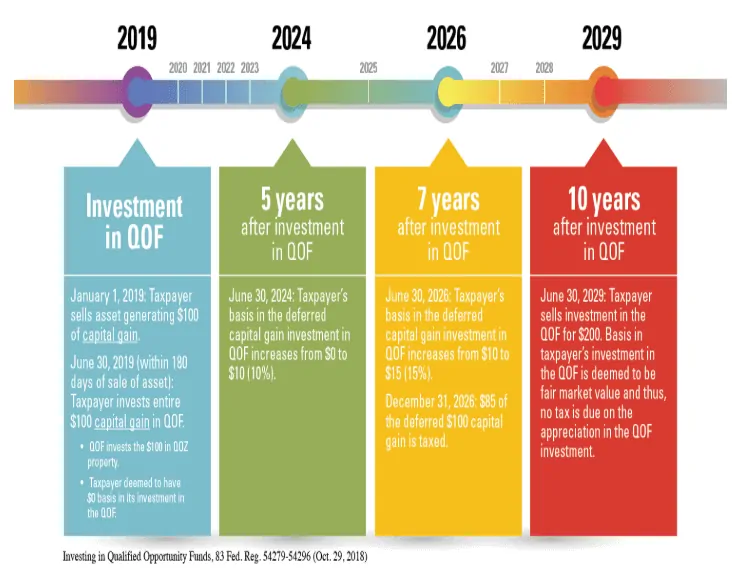

As an incentive for the investor to invest in a QOZ, or “Qualified Opportunity Zone”, the federal government offers up to a full tax holiday on capital gains for assets held for at least 10 years.

Opportunity Zones have the following benefits for both investors and communities, as outlined by Sacramento County Economic Development.

For Investors:

- Deferral of the original capital gains taxes invested in a QOF. Investors can defer their original tax bill until December 31, 2026 at the latest, or until they sell their Opportunity Fund investments, if earlier

- When investments are held for five years, 10% increase in rolled-over federal capital gains basis

- When investments are held for seven years, 15% increase in rolled-over federal capital gains basis

- Opportunity fund investments held in the fund for at least 10 years are not taxed for federal capital gains

Opportunity to invest in a diversified portfolio of QOF projects throughout the U.S./U.S. Territories, including businesses, property, infrastructure, etc.

For Communities:

- Opportunity to attract investment and financial support for businesses, housing, commercial development, and infrastructure projects within the local community.

Opportunity zone tax advantages for data center customers

Here’s the big caveat. In order for a data center tenant to take advantage of these tax breaks, they would need to share some of the equity in the data center real estate.

So if you are exclusively using cloud providers, and/or retail colocation providers to supply your company’s data center needs, you won’t be able to benefit from these impactful tax benefits.

In order to benefit, you’ll need to find a wholesale data center developer who is willing to enter into an equity sharing agreement with your company.

Also important to keep in mind in order to get a true sense of the size of the potential tax break: it’s not just the capital gains on the buildings themselves. It’s also the equipment that goes into the buildings. And in the data center world, we know that the value of the equipment we stuff the data center building with is huge.

CFO or CIO? Data center decision-makers

This is exactly why we strongly recommend that data center site selection teams are made up of a cross-functional representation of folks reporting to at least the Chief Financial Officer and the Chief Information Officer or their equivalents.