Data Center Considerations for the Finance and Facilities Departments

There are a lot of financial considerations and variables involved in making the right decision about how to structure your company’s data center real estate. It can be complicated. This post will boil it down to the basics.

The good news is that at the most basic level, it’s not all that different from choosing to rent or buy your home. The two major differences are that:

- When you have an ownership stake, you benefit from an immediate decrease in your monthly occupancy cost, through your share of the net operating income of the property.

- Due to the uplift in market value from unoccupied space to occupied space in a data center, you immediately make money on your real estate investment.

What are the primary options?

Some of the most common data center financing options are:

- Service contract, such as colocation

- Real estate lease

- Sale/leaseback

- Build-to-suit

- Lease-to-own

- Full ownership

- Joint venture

What are the primary variables to consider?

- Company cash flow and balance sheet

- Local and federal accounting regulations

- Local and federal tax regulations

- Type of data center involved

- Age of data center involved

- Core competencies of your company

- Desired degree of control

Now that we’ve covered the most common models and the most important variables to consider, let’s look at recommendations by scenario.

When ownership makes sense

Having at least a partial ownership stake in your latest data center makes a lot of financial sense if your company meets the following criteria:

- Healthy cash flow and/or cash-rich balance sheet

- The data center in question is new

- Your company has specific standards for things like layout, electrical, mechanical, cable trays, etc…creating a Joint Venture with the builder can provide this control

- Your company wants a high degree of control over the facility

Additionally, look for these local criteria as a signal that ownership may make more sense:

- Local and/or federal tax incentives available

- If you are considering property in a Qualified Opportunity Zone (QOZ), your company needs a capital gain it can transfer to a Joint Venture in order to take full advantage of the tax benefits

For deeper background, there’s a great post from WiredRE titled “Data Center Decisions: Building vs. Leasing Data Center Space”. AreaDevelopment also has an excellent overview titled “Data Center Development and Financing Strategies“.

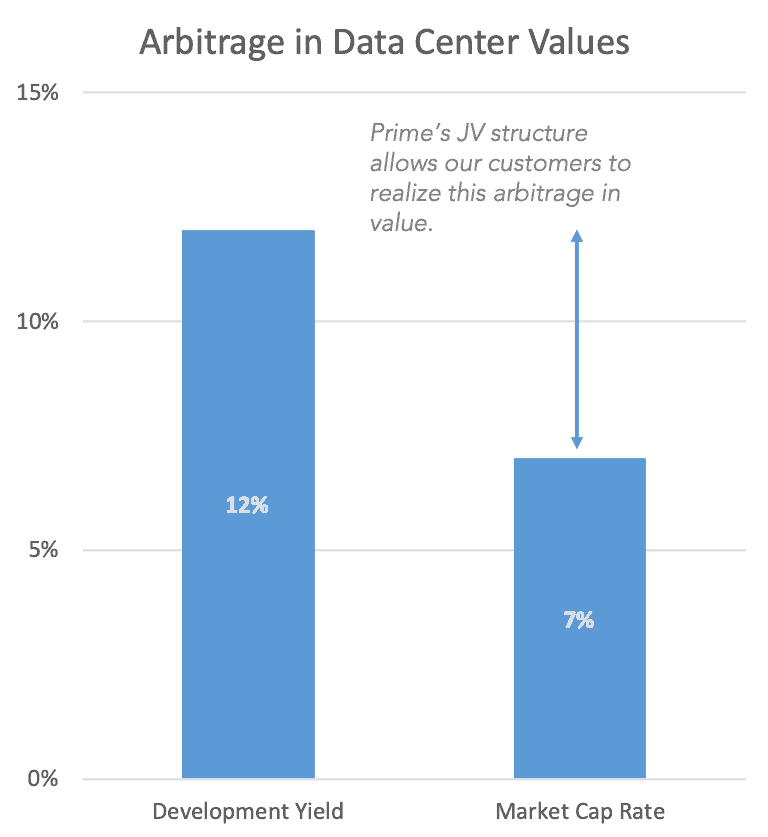

When a JV structure makes sense

One of the things that makes Prime Data Centers unique is that we offer flexible financing options, including a joint venture (JV) relationship. A JV structure can provide important financial benefits to your firm if you want to:

- Reduce liabilities and increase assets on your balance sheet

- Reduce your cost of capital/financing costs

- Take full advantage of available tax incentives

- Increase earnings and build book value

- Maximize your per share valuation

Entering into a JV with the builder ensures pricing and terms transparency. In addition, you are participating in the profit related to the lease and real estate appreciation.

Structuring a JV with Prime can provide significant tax benefits based on the Qualified Opportunity Zone (in our Sacramento location only). Your company can potentially transfer capital gains to the JV.

When a sale/leaseback makes sense

- Get a large CapEx item off the books

- Reduce the significant overhead related to facilities and facilities management so you can focus resources on your core business

- The company is considering implementing “cloud” but not all data and applications are appropriate for the shared infrastructure and lower availability inherent to cloud. Sale-Leaseback is a great way to implement a hybrid solution, enabling the reduction of costs, with the ability to meet your internal SLA’s

For additional details, the Site Selection Group has a good post titled “Sale Leasebacks in the Data Center World and Their Importance”.

When a build-to-suit makes sense

Build-to-suit is an attractive option if your company meets the following criteria:

- Need to ensure some future scalability

- You want greater control than a colocation arrangement

- You don’t have the expertise required in site selection and/or construction and operation

- You’re concerned with managing costs and partial or total ownership doesn’t pencil out for you

- You want to use OpEx rather than CapEx

- You want to focus your resources on your core business

Next Steps

If your company wants some input into your data center financing strategy, we’re here to help! Simply chat with us using the green chat icon in the bottom right of this screen or send us an email: info @ primedatacenters dot com. You can also chat with us on Twitter.